Go after all other choices: If none pan out, speak with your creditor to determine if you can get a lot more time, work out a payment strategy or manage the small-expression fiscal repercussions of not paying out, for example late costs.

If you will need to make use of a motor vehicle title personal loan, read the good print to ensure you comprehend Whatever you’re moving into. All loans come with risks if they’re not repaid on time. Nonetheless, a vehicle title mortgage carries an Specifically troubling consequence in the event you fail to fulfill your payment obligations: The lender normally takes your car.

The applying approach is usually simple, and when accepted, you'll be able to anticipate to acquire funding the moment 24 several hours later — at times even sooner.

Has to be at the least 18 decades of age (19 in Alabama). Account acceptance calls for fulfillment of all eligibility specifications, including a credit history inquiry, a motorcar appraisal and an assessment of title issue. Need to current valid governing administration issued ID.

Must be at the least 18 many years of age (19 in Alabama). Account approval demands satisfaction of all eligibility prerequisites, which includes a credit inquiry, a motorized vehicle appraisal and an evaluation of title problem. Need to existing legitimate govt issued ID.

Q2: Simply how much cash can I receive by way of a fairness pawn? The personal loan quantity will depend on the wholesale value of your car. We could possibly get you up to 80% on the wholesale price, but it will eventually rely on the lender.

To secure a vehicle title bank loan, you provide the lender the title on your vehicle – as an example, your vehicle, truck or motorbike. You furthermore mght pay back the lender a rate to borrow the money. You usually need to repay the mortgage in 30 times.

A devout Buddhist, i was read more born in the state of Perak Section of west Malaysia. I produce this site only with the mission to market Buddhist values for the benefit of Other people.

A vehicle title financial loan uses the value of the car or truck as collateral. You can borrow around fifty percent of the value of your vehicle.

Desire prices on pawnshop financial loans change by condition and typically are introduced as charges, but it’s extra valuable to compare financial loans concerning once-a-year proportion fee. Even though payday financial loans and car or truck title financial loans can easily top rated 400% APR, pawnshop loans could possibly be additional cost-effective, with APRs about 200%.

We have confidence in creating the process of pawning your automobile title as uncomplicated as is possible, so you might have a single considerably less point to worry about. We provide custom-made payment ideas that be just right for you for making your payments and Get better your title speedily. Fill out our on the net varieties or go to one of our welcoming areas and get the dollars you will need today.

Failure to repay only brings about losing the pawned product: There’s no legal necessity to repay a pawnshop bank loan, so your credit history rating received’t put up with in the event you don’t repay, nor will you be harassed by financial debt collectors or sued. The one consequence is shedding your product.

Quite a few or the entire products featured Listed here are from our partners who compensate us. This influences which items we compose about and the place And just how the product or service appears on the webpage.

Auto financial loans guideBest auto financial loans permanently and negative creditBest vehicle loans refinance loansBest lease buyout financial loans

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Lark Voorhies Then & Now!

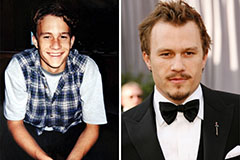

Lark Voorhies Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!